All you have to See

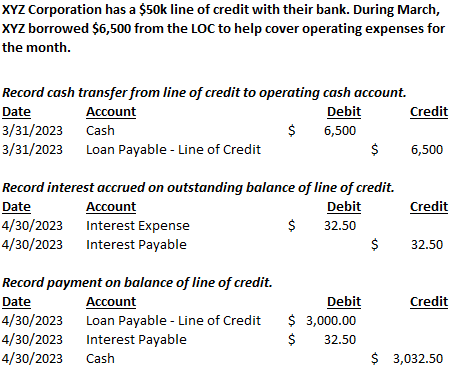

- The entire process of delivering a mortgage with no employment seems merely for example providing any other financial. The biggest huge difference is recording your income

- A loan provider tend to decide if you might be good applicant for a good financial in accordance with the suggestions found in the job and you will financial data files

- A few of the getting a home loan without a job are to inform you a leading money, rating a good co-signer, fool around with nontraditional earnings present or put more funds down

Material

The utilization scene looks much more today than just it did a beneficial number of years back. Anywhere between ongoing pandemic-relevant disruptions, the good Resignation plus the rise off concert works, more people than ever was thinking if they rating a home loan or refinance their home financing rather than an entire-day work.

Sure, providing home financing otherwise refinancing your home financing without a job is achievable. It possesses its own gang of demands. On this page, we will speak about a method to help you qualify for home financing rather than a position.

Ways to get a mortgage otherwise Re-finance when you are Unemployed

The process of delivering a mortgage with no employment looks simply instance delivering almost every other financial. The largest huge difference try recording your income with no employment. Indicating on financial that you could pay off the mortgage was crucial. After all, making sure the loan was paid back is the first matter. Without a job, the lender usually carefully test thoroughly your application. Very you have to be thorough whenever setting up proof you could potentially pay the borrowed funds.

Prepare your situation

You ought to earn new lender’s trust. Ready your situation and feature the lending company as to why they want to trust you. Being able to prove you may be economically secure is specially crucial.

Possibly you may be transitioning anywhere between spots and will begin your jobs in the future. Or perhaps your own occupation are regular. Any sort of your needs, Jewett City CT pay day loans you’re more likely to getting accepted whenever you can tell you this new bank you may have consistent monthly earnings to possess 8 weeks of year and can efficiently budget for their month-to-month mortgage payments to possess the other cuatro.

An important will be willing to tell you a home loan company you may have an idea and also be able to make the payments.

Keep in touch with a houses specialist

The brand new U.S. Institution off Casing and you may Urban Innovation (HUD) even offers 100 % free or reasonable-cost casing guidance properties so you can anybody who means they. HUD-approved advisors can help you understand the options and the processes of getting home financing, if you have got work or perhaps not. They’re able to and additionally help you work-out a funds and construct a want to change your financial predicament.

Pick a co-signer

A beneficial co-signer are somebody who believes to take on the latest economic responsibility out of repaying that loan if you cannot match the obligation. This means for people who standard into the loan, the brand new co-signer is found on this new connect toward balance. Due to this, co-signers are typically friends or family which see you and trust you’ll be able to make a good on your obligations.

Fool around with financial support earnings

Many people use money out-of investment to enable them to score a beneficial financial. You might cash-out expenditures to improve the deposit matter or express the important points of the investments toward financial so you can demonstrated your capability to expend the loan. That is of use, but due to the unpredictability of most opportunities, it income actually managed an identical regarding the sight off a bank and certainly will hence end up in higher interest rates.

Some financial investments, including particular annuities, become more steady as opposed to others. For those who have money out of a reliable financial support, an underwriter are more ready to think about the income so you can qualify your having a mortgage.

Leave a comment