Submit an application for a mortgage when you look at the Ca Today!

On Cover The usa Financial, the audience is happy to help you suffice anyone who has supported our very own nation. We help experts and their family members to view sensible lenders in the Ca, through the Virtual assistant, making its fantasy domiciles an actuality.

Do you want to start your property mortgage process? Following merely submit the fresh new small you to-moment form below to begin! We will offer a no-obligations visit so you’re able to guess just how much you might be in a position to acquire.

Why would I have a good Va-Recognized Mortgage for the California?

Which have business-category locations particularly San francisco bay area and you can La, unbelievable weather throughout every season, and you will healthy living, there’s multiple reason why you might make use of Veterans Mortgage advantage to get your dream family when you look at the the fresh new Golden County.

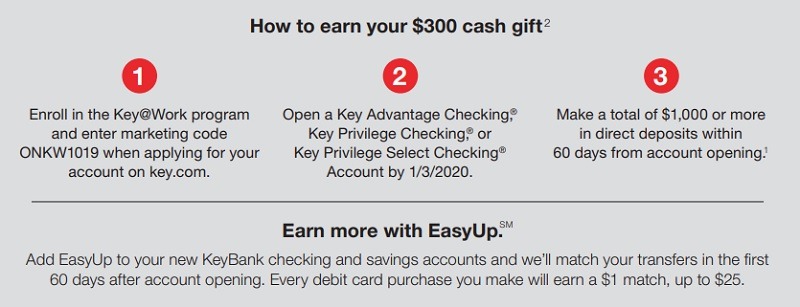

Likewise, financing limitations in Ca include condition in order to county, according to casing ento’s average listing house sales price is $520,000 when you look at the 2022. Basically, Virtual assistant financing limits select a giant top-up within the 2022, for the simple Virtual assistant financing restrict expanding in order to$647,200 compared to $548,250 within the 2021. The latest Va mortgage constraints and additionally enhanced for highest-prices counties peaking at the $970,800 to possess just one-family home. Amazingly, Va financing constraints was inadequate getting licensed experts which have full entitlement. not, the fresh restrictions however connect with veterans in the place of full entitlement.

And additionally, VA-Recognized Finance require an effective 0% down-payment oftentimes, while old-fashioned money generally need at the very least good step 3% downpayment and regularly up to 20% required; FHA finance want at least step 3.5% down payment. And you will, that have an excellent Va Home loan, veterans will not need to spend people monthly mortgage insurance rates, which can’t be told you from the traditional or FHA mortgages.

What exactly is a beneficial Jumbo Mortgage during the Ca?

Of numerous Veterans have rooked their Virtual assistant mortgage masters. With relaxed degree requirements and much more flexibility, its shown to be the best selection for most so you’re able to pick and you may re-finance their houses from this program. not, in a few California counties, the latest compliant mortgage restriction no money off are $548,250. If for example the household costs more that it, the solution try a great Va Jumbo Financing. An effective Va Jumbo Financing was people Va-Backed Loan larger than $548,250. And you can being qualified Veterans can use purchasing or re-finance their residence for a value of $step one,000,000 through this type of financing, and additionally searching every benefits of the overall California Virtual assistant Mortgage.

These are the Secret Pros one to Safety The united states can offer you to track down a great Va Fund inside Ca

- Va, FHA, and all of Financial Sizes.

- $0 Deposit to possess Va Home loans.

- No need for Private Mortgage Insurance rates.

- Competitive appeal cost.

- Straight down Repayments.

- More straightforward to Meet the requirements.

- Informal Credit Requirements.

Virtual assistant Mortgage Evaluation

California Va bad credit installment loans Louisiane Mortgage brokers is actually finance supplied to armed forces veterans, reservists, and you can energetic-duty people to buy a primary household. The newest Veterans Government cannot give money with the mortgage; alternatively, they promises the big 25 % of your fund made by private lenders, eg Security The usa Home loan, to the people compliant towards the Va Financing Qualifications requirements.

Certified veterans may use their financing positive points to purchase a property which have no money down, no private financial insurance rates, and also have the providers pay all the closing costs. These types of professionals and you can extremely aggressive interest levels create Va Funds from inside the Ca, the preferred financing option for of several pros.

Va Financial Rates and Can cost you

Virtual assistant Finance inside the Ca have a similar expenses associated with closure since the any financial affairs, but there are two trick variations in closing costs having a great VA-Recognized Loan. Basic, if negotiated towards the pick offer, the seller can pay all the closing costs and prepaid activities, totaling doing five % of purchase price. 2nd, brand new Agencies away from Experts Circumstances fees an effective Va Money Percentage into every mortgage they pledges.

The latest Va Resource Fee are paid back right to the new Virtual assistant and you can helps to purchase our home Loan System for everybody latest and you may future homeowners. That it Percentage ranges from.25 % to three.3 % it is waived to possess veterans that have provider-linked disabilities. Plus, the fresh new Va Money Commission is paid-in full or folded into financing from the closure.

Generally speaking, the eye prices getting Virtual assistant Funds in the Ca try lower whenever versus old-fashioned and you will FHA loans. Nevertheless, you can check out our very own Va Online calculator in order to dictate your instalments!

Leave a comment